It’s time for online merchants to face facts. We live in a digital world, and there should be little doubt that digital currencies are the wave of the future.

As an online merchant, your success depends on your ability to recognize trends and react to make sure you don’t miss the boat. Over the last five years, cryptocurrencies have slowly but surely been gaining popularity as a means of exchange between customers and online merchants. Are you taking steps to make sure customers can pay you with digital currencies?

As part of a drive to get merchants up to speed on the world of cryptocurrencies, we offer you these five tips on preparing to accept crypto payments in the future.

-

Find the Right Payment Platform

If you want to integrate a crypto payment platform with your online store, you need to shop around for the right platform/exchange. While you have a lot of choices, you might want to focus on popular platforms Coingate, Spicepay, OKEX, and BitPay.

As you go through the selection process, you will discover there are several factors you need to consider. The things you should focus on are transaction fee charges, security, payout options, and whether or not the platform will allow you to conduct business through multiple cryptocurrencies.

While Bitcoin is the most widely used cryptocurrency, others such as Etherium are gaining popularity with consumers.

-

Plan to Accept Multiple Cryptocurrencies

Today, Bitcoin stands as the most popular crypto payment option. However, there is no way of predicting which coins will be most relevant in the years to come. At a minimum, you should be looking for a payment platform that accepts common coins like Litecoin, Ripple, Bitcoin, and Ethereum.

You should also be looking for a platform that can easily integrate access to the coins of tomorrow. Keep your eye on the crypto market for new coins that are created. You never know which will become the next preferred coin in the marketplace.

-

Focus on the Endgame

Cryptocurrency volatility can be a little intimidating. However, you can’t let that dictate how you do business. Your job is to focus on the endgame. What is the endgame? As a merchant, you are in the business of selling products to as many customers as possible. By accepting cryptocurrency payments, you will increase your potential customer base and open your door to new customers from all over the world.

-

Don’t Hoard Coins in Your Wallet Account

When you start accepting digital payments, you will be responsible for managing your payment wallet. As crypto payments come in, you will need to immediately decide whether you want to trade coins like BTC to INR, EUR or USD (Fiat). Given the volatility of the crypto marketplace, hoarding would be a form of speculating.

For instance, let’s say you accepted Bitcoin as a payment form for a customer purchasing your product or service and kept the Bitcoin in your digital wallet. You would be speculating that the price of Bitcoin would continue to rise therefore making you a profit on that investment. The potential downside of doing this is if the price of Bitcoin went down before you cashed out which would result in you losing money on that investment.

If you are not looking to trade the market, you need to do payment conversions from cryptocurrency to fiat as frequently as possible.

-

Understand the Risks Associated With Accepting Crypto Payments

Transacting business with cryptocurrencies is still a fairly new concept. It’s vastly different than dealing with fiat currencies because of additional risks. We have already discussed the risk associated with crypto market volatility. The other major risk is getting a visit from hackers. The best way to protect your money is to select a platform with multiple levels of security and convert your receipts as fast as possible.

Steps to Start Accepting Crypto Payments

Now that you understand some tips for managing cryptocurrency payments at your business, we will discuss what steps you need to take in order to make these forms of payment a reality.

- Register for a Bitcoin wallet: Before you can start accepting Bitcoin, or other cryptocurrencies, you need to register for a crypto wallet. This is a digital location where customers can send Bitcoin as payment. There are a number of wallet services like BTC.com or you can get a wallet address directly from a cryptocurrency exchange like OKEx. Your wallet is a unique string of letters and number that correspond to your account. You will also receive a private key which is used to sign for the Bitcoin transaction. These private keys need to be kept secret for security purposes. It’s a good idea to provide your wallet address in the form of a QR-code to make it easy for customers and help keep your wallet safe from hackers.

- Get a Bitcoin POS (for offline businesses): Just like a standard POS (point of sale system), companies like Bitpay and Coinkite have created Bitcoin specific POS devices for offline businesses to accept cryptocurrency transactions. Some customers may have Bitcoin based debit cards which makes having these devices easy for them to purchase.

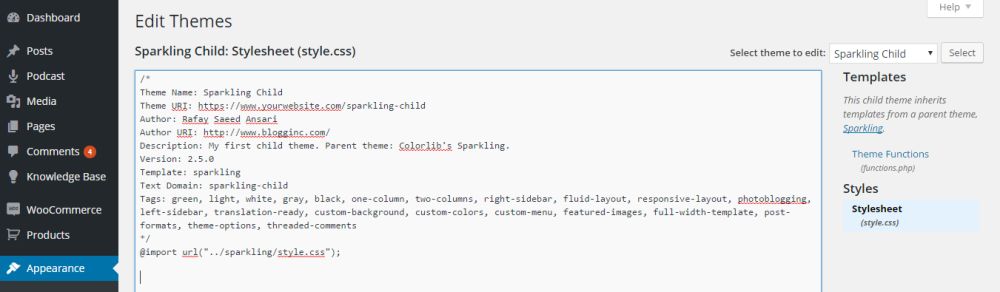

- Online payment buttons: For digital businesses, like an eCommerce retailer, offering a Bitcoin payment button is critical for customers who pay using digital currencies. Services like BitcoinPay and even Stripe offer Bitcoin payment options via a digital button for websites. All you have to do is fill out a simple form on their website and get a few lines of HTML code to place on your payment form. Your account is then connected to your wallet for payments.

Wrap Up

As we enter 2021, more and more customers are adopting cryptocurrencies as a form of payment. This means businesses need to do the same in order to keep growing. Use these best practices to create a seamless customer experience no matter what type of business you are and keep your revenue safe from hackers.

via https://ift.tt/3nYVAJw